12 cash flow diagram

Table of Contents

Table of Contents

Are you struggling with understanding how to draw a cash flow diagram? It may sound simple, but it can be tricky without the proper knowledge. In this blog post, we will go over everything you need to know about how to draw a cash flow diagram, from the basics to more advanced topics.

Pain Points related to How to Draw a Cash Flow Diagram

Understanding how to draw a cash flow diagram can be complicated, especially when you are unfamiliar with the concept. The process can quickly become overwhelming, and mistakes can be made easily, resulting in an inaccurate diagram. Without proper guidance, you may find it challenging to know where to start, what items to include, and how to apply the correct formulas.

Answer: How to Draw a Cash Flow Diagram

A cash flow diagram is a visual representation of the cash flows for a project or investment. It shows the inflows and outflows of cash for each period. The diagram is divided into sections representing periods in time and arrows representing the direction of cash flow. Typically, cash flow diagrams begin with a negative value for the initial investment and end with positive values representing cash inflows.

When drawing a cash flow diagram, start by determining the cash inflows and outflows for each period. Next, label each period and draw a horizontal line representing the x-axis. Each cash inflow is represented by an upward arrow, and each cash outflow is represented by a downward-pointing arrow.

Calculate the net cash flow for each period, and plot the net cash flow at the appropriate point on the y-axis. The diagram should end with the cumulative net cash flow, which is the sum of all the net cash flows over time. Your cash flow diagram should be accurate, clear, and easy to follow.

Main Points Related to How to Draw a Cash Flow Diagram

- A cash flow diagram is a visual representation of cash inflows and outflows of a project or investment over time.

- Start by determining cash inflows and outflows for each period, labeling each period, and drawing a horizontal line representing the x-axis.

- Cash inflows are represented by upward arrows, and cash outflows are represented by downward-pointing arrows. Plot the net cash flow at the appropriate point on the y-axis.

- The diagram should end with the cumulative net cash flow, which is the sum of all the net cash flows over time.

How to Draw a Cash Flow Diagram – A Personal Experience

When I first learned how to draw a cash flow diagram in college, I was intimidated by the concept. It looked confusing and complicated at first, but once I followed the steps, it became easier. I found it helpful to break the diagram down into different periods and focus on each separately. By plotting the net cash flows at the appropriate points, I was able to see the cash flow and understand it better.

It is a good practice to include images to help illustrate the steps. The images should include alt tags that describe the image for people with visual impairments. Adding paragraphs to the images provides additional context and helps you to explain the concepts better.

How to Draw a Cash Flow Diagram – Common Mistakes

One of the most common mistakes when drawing a cash flow diagram is mislabeling the periods. Another mistake is using the wrong formula to calculate the net cash flows. Make sure to double-check your work to avoid simple errors.

Another mistake is ignoring the time value of money. The value of money changes over time due to inflation, so it is vital to consider this when drawing a cash flow diagram. You need to discount future cash flows to their present value to ensure accuracy.

Discounted Cash Flow Diagram

The discounted cash flow diagram is a variation of the standard cash flow diagram that considers the time value of money by discounting future cash flows. To calculate the net present value, you need to use a discount rate, typically the cost of capital or the WACC (weighted average cost of capital).

Discounted cash flow diagrams can provide a more accurate picture of a project or investment by including the cost of capital. However, it requires additional calculations that can be more complex.

Opportunity Cost and Sunk Cost

When drawing a cash flow diagram, it is essential to consider the opportunity cost and sunk cost. The opportunity cost is the cost of the next best alternative forgone. The sunk cost is a cost that has already been incurred and cannot be recovered.

It is crucial to include these costs in the cash flow diagram to provide a more realistic picture of the project or investment. By understanding the costs involved, you can make better decisions and avoid costly mistakes.

Question and Answer

Q1: What is the purpose of a cash flow diagram?

A: A cash flow diagram is a visual representation of the cash flows for a project or investment. It shows the inflows and outflows of cash for each period.

Q2: How do you draw a cash flow diagram?

A: Start by determining the cash inflows and outflows for each period. Label each period and draw a horizontal line representing the x-axis. Each cash inflow is represented by an upward arrow, and each cash outflow is represented by a downward-pointing arrow. Calculate the net cash flow for each period, and plot the net cash flow at the appropriate point on the y-axis. The diagram should end with the cumulative net cash flow.

Q3: What are the common mistakes when drawing a cash flow diagram?

A: The most common mistakes include mislabeling the periods, using the wrong formula to calculate the net cash flows, and ignoring the time value of money.

Q4: What is a discounted cash flow diagram?

A: A discounted cash flow diagram is a variation of the standard cash flow diagram that considers the time value of money by discounting future cash flows. To calculate the net present value, you need to use a discount rate, typically the cost of capital or the WACC.

Conclusion of How to Draw a Cash Flow Diagram

Understanding how to draw a cash flow diagram is an essential skill that can help you analyze and evaluate projects and investments more effectively. By following these steps, you can create accurate and easy-to-understand diagrams that provide a more realistic picture of the cash flows.

It is crucial to avoid common mistakes and consider the time value of money, opportunity cost, and sunk cost to make better decisions. With this knowledge and practice, you can confidently draw cash flow diagrams and analyze projects and investments more effectively.

Gallery

Cash Flow Diagrams | 101 Diagrams

Photo Credit by: bing.com / gopixpic

Cash Flow Diagrams | 101 Diagrams

Photo Credit by: bing.com /

12+ Cash Flow Diagram | Robhosking Diagram

Photo Credit by: bing.com /

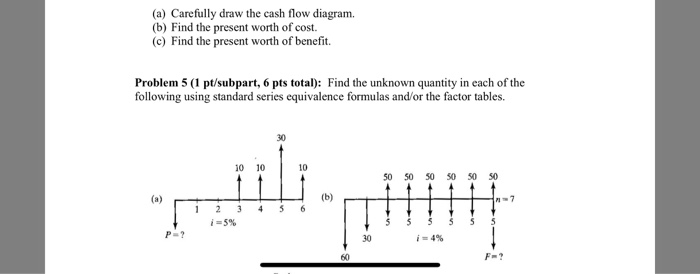

(a) Carefully Draw The Cash Flow Diagram. (b) Find | Chegg.com

Photo Credit by: bing.com / flow cash diagram draw find chegg carefully hasn answered expert ask question yet been

Solved: Draw A Cash Flow Diagram For The Following Situati… | Chegg.com

Photo Credit by: bing.com / cash flow diagram draw following situation remember scale transcribed text