Resistance support forex use drawing line chart zones trading strategies mt4 levels babypips example price secrets go indicators tips plotting

Table of Contents

Table of Contents

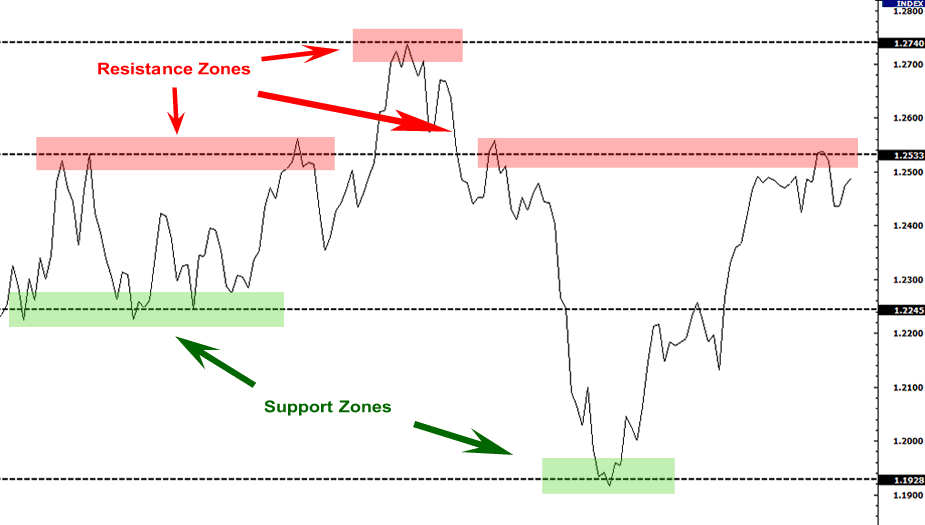

Learning how to draw support and resistance zones is a crucial aspect of technical analysis in trading. It can greatly aid in the decision-making process, as support and resistance levels often provide a high probability of potential areas for trades. In this article, we will explore the techniques and tools needed to effectively draw support and resistance zones.

Pain Points Related to Drawing Support and Resistance Zones

Without proper knowledge and understanding, drawing support and resistance zones can be a daunting task for traders. The lack of consistency and differing opinions on where to draw these levels can become overwhelming. This can result in missed trade opportunities or taking trades based on inaccurate levels.

Answering the Target of Drawing Support and Resistance Zones

The goal of drawing support and resistance zones is to identify potential areas of buying and selling pressure. Support levels are areas where price has historically bounced from and resistance levels are areas where price has had difficulty breaking through. By identifying these levels, traders can use them as potential entry and exit points for trades.

Summary of Main Points

To draw support and resistance zones effectively, one must first identify key levels using methods such as trend lines, horizontal lines, and Fibonacci retracements. It is important to look for areas where price has reacted multiple times, as these areas are stronger levels of support and resistance. Additionally, it is crucial to consider other factors such as volume and market structure when drawing these levels.

Identifying Key Levels with Trend Lines

One efficient way to draw support and resistance zones is by using trend lines. By identifying a trend and drawing a line connecting multiple swing lows for an uptrend, or swing highs for a downtrend, one can start to form levels of support and resistance. It is important to note that trend lines are subjective and can differ between traders.

Using the Zigzag Indicator

Using the Zigzag Indicator

Another tool that traders can use to draw support and resistance lines is the zigzag indicator. This indicator is designed to help identify trends and key levels by filtering out small price movements. Traders can adjust the settings of the indicator to best fit their trading style and use it in combination with other tools to confirm potential levels.

### Drawing Zones with Horizontal Lines

### Drawing Zones with Horizontal Lines

Horizontal lines are another tool commonly used to draw support and resistance zones. Traders can draw lines at key levels where price has had difficulty breaking through in the past. These levels are often viewed as potential areas for trades as they can provide a high probability of price reacting once again.

Using Fibonacci Retracements

Traders can also use Fibonacci retracements to identify potential levels of support and resistance. Fibonacci retracements are based on the idea that after a price move, the price will often retrace a predictable portion of the move before continuing in the same direction. By drawing retracement levels at these points, traders can identify potential levels to watch for price reactions.

Personal Experience Using Support and Resistance Zones

When I first started trading, I struggled with how to effectively draw support and resistance zones. It wasn’t until I learned to use multiple tools, such as trend lines and horizontal lines, that I started seeing consistency in my analysis. I also learned that it is crucial to consider other factors, such as market structure and volume, when drawing these levels.

Common Questions About Drawing Support and Resistance Zones

Q: Can support and resistance levels be subjective?

A: Yes, support and resistance levels can differ between traders and can often be subjective. It is important to identify key areas where price has reacted multiple times and be consistent in your analysis.

Q: How often should I redraw support and resistance lines?

A: It is important to redraw support and resistance lines when they are no longer relevant. As price moves and reacts, key levels may change. Traders should constantly monitor price and adjust their levels accordingly.

Q: Can support turn into resistance and vice versa?

A: Yes, support levels can turn into resistance levels after they have been broken and vice versa. It is important to consider market structure and price action when identifying potential levels.

Q: How do I know which levels are stronger?

A: Stronger levels are identified by areas where price has reacted multiple times. These levels are viewed as stronger because they have been tested multiple times and are less likely to break on the next test.

Conclusion of How to Draw Support and Resistance Zones

Drawing support and resistance zones is a crucial aspect of technical analysis in trading. By using tools such as trend lines and horizontal lines and considering other factors, traders can effectively identify potential areas for buying and selling pressure. It is important to constantly monitor price and adjust levels accordingly to ensure accuracy in analysis.

Gallery

A Powerful Way To Draw Support And Resistance Zones - Desire To Trade

Photo Credit by: bing.com / support resistance draw zones powerful way

How To Draw Support And Resistance Zones - Becoming Trader FX

Photo Credit by: bing.com / resistance draw support zones

The “Resistance-Support Zones” Indicator - Automatic Drawing Of Support

Photo Credit by: bing.com /

Forex Trading: Forex Strategies: Support And Resistance Secrets

Photo Credit by: bing.com / resistance support forex use drawing line chart zones trading strategies mt4 levels babypips example price secrets go indicators tips plotting

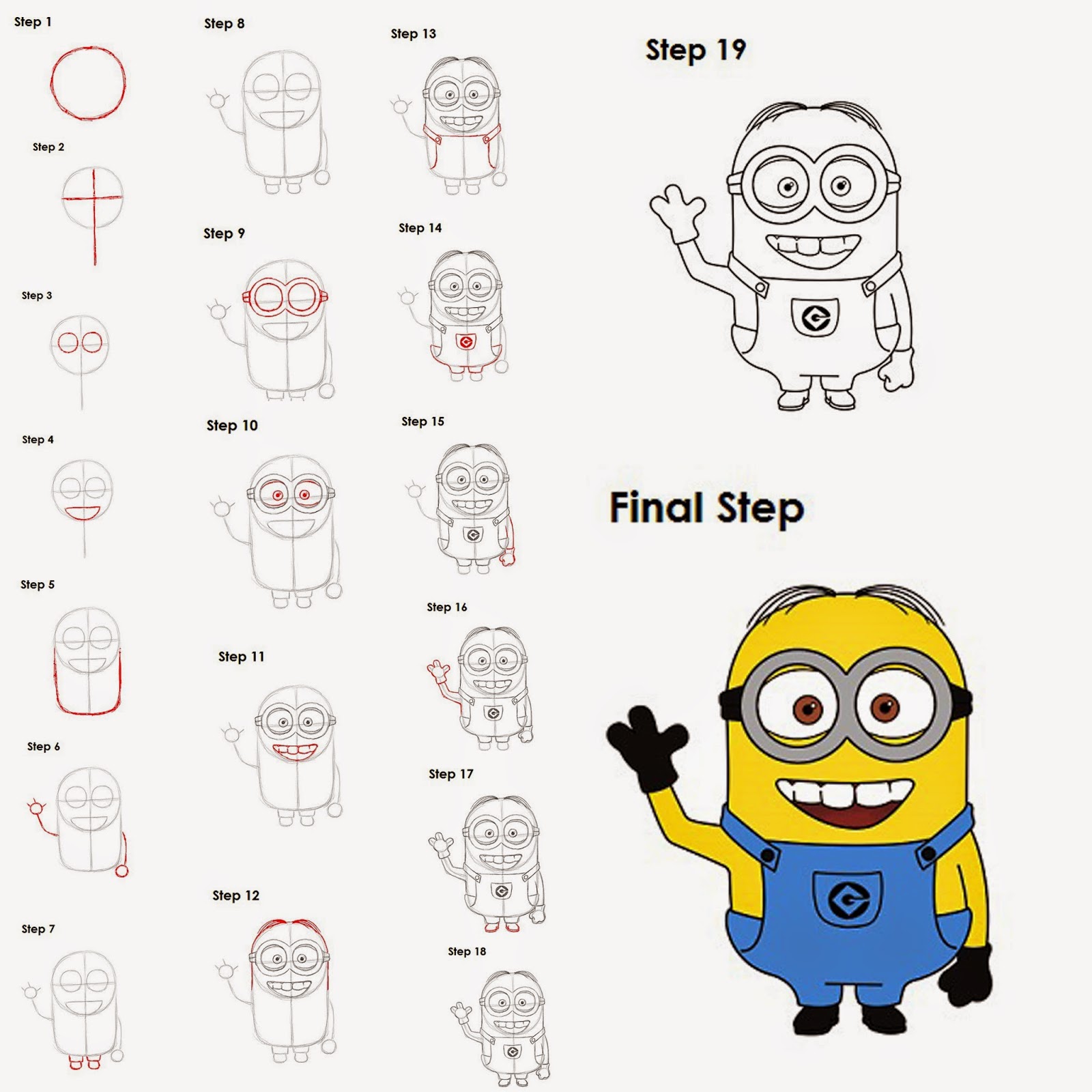

How To Draw SUPPORT And RESISTANCE Zones: Step-by-step Approach

Photo Credit by: bing.com / zones resistance support step approach draw